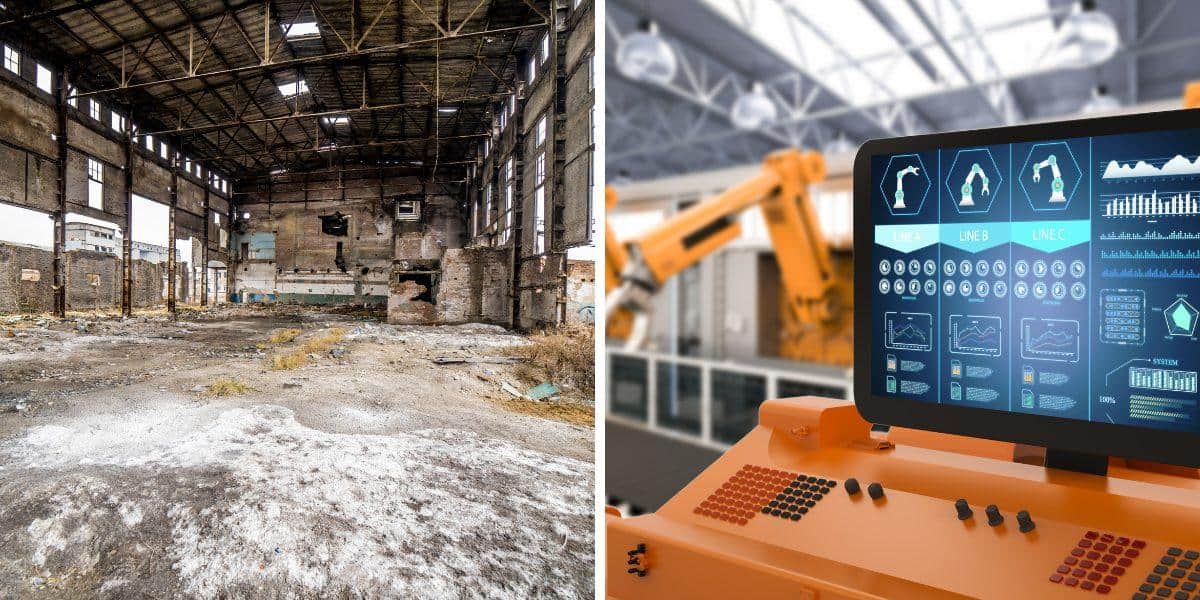

In today’s intricate business landscape, supply chain disruptions can significantly impact manufacturing operations, leading to delays, financial losses, and compromised customer satisfaction.

But can manufacturing insurance provide a safety net against such unforeseen hiccups?

This article delves into the realm of manufacturing insurance, a critical tool designed to shield businesses from the unique challenges of production and distribution, including supply chain disruptions.

With a focus on how this specialized insurance can cover various disruptions, from natural disasters to vendor bankruptcy, we aim to unravel the complexities of policy specifics, coverage conditions, and the types of disruptions that are typically covered.

Whether you’re a seasoned manufacturer or new to the industry, understanding the nuances of manufacturing insurance and its role in safeguarding against supply chain disruptions is essential for maintaining operational continuity and financial stability.

Join us as we explore the ins and outs of manufacturing insurance, offering insights on achieving comprehensive coverage and best practices for managing the risks of supply chain disruptions.

What is Manufacturing Insurance?

Manufacturing insurance is a specialized form of coverage designed to protect businesses involved in the production and distribution of goods against a wide range of risks.

This type of insurance is essential for manufacturers as it addresses the unique challenges and exposures they face, including equipment breakdowns, supply chain disruptions, product liability issues, and employee safety concerns.

The core goal of manufacturing insurance is to safeguard the financial stability of manufacturing operations by providing a safety net that covers the cost of unexpected events, such as damage to property or machinery, legal fees, and compensation claims.

By mitigating these risks, manufacturing insurance enables businesses to continue their operations with minimal interruption, ensuring that they can meet their production targets and maintain their competitiveness in the market.

Tailored to the specific needs of each manufacturing entity, this insurance can encompass a variety of policies, including property insurance, liability insurance, business interruption insurance, and workers’ compensation, among others.

Understanding and selecting the right manufacturing insurance coverage is crucial for manufacturers aiming to navigate the complexities of the industry while securing their assets, employees, and overall business continuity.

Does Manufacturing Insurance Cover Supply Chain Disruptions?

Business interruption insurance plays a pivotal role in mitigating the financial impact of supply chain disruptions on manufacturing operations.

This coverage is crucial, as studies show that supply chain disruptions can lead to an average 45% decrease in stock returns and 107 days to recover fully.

When manufacturers encounter disruptions—whether from natural disasters, political unrest, or vendor bankruptcy—this type of insurance provides crucial coverage for the lost income resulting from halted production or sales.

For example, after the 2011 Thailand floods disrupted global supply chains, Western Digital received a $608 million insurance payout, demonstrating the significant financial protection this coverage can offer.

The coverage extends to losses incurred from disruptions affecting both direct suppliers and indirect suppliers, ensuring a comprehensive safety net for manufacturers.

A real-world application of this was seen when a fire at a Philips microchip plant in New Mexico led to significant losses for its customer, Nokia. The company’s business interruption insurance helped cover an estimated $100 million in lost sales.

To activate the coverage, manufacturers must demonstrate the financial loss directly linked to the supply chain disruption, adhering to the policy’s documentation requirements.

This typically involves:

- Documenting the disruption event

- Quantifying the financial impact

- Providing evidence of lost sales or increased costs

The claim process involves submitting this evidence, which then informs the calculation of the loss covered by the policy. On average, business interruption claims can take 6-12 months to settle, highlighting the importance of thorough documentation and prompt reporting.

This insurance coverage is designed to support manufacturers through periods of operational uncertainty, offering financial stability and assistance until the supply chain is restored and normal operations can resume.

For instance, after the 2011 Japanese earthquake and tsunami, many affected companies relied on their business interruption insurance to cover losses and maintain operations during the recovery period, which lasted an average of 9-12 months for severely impacted businesses.

What are the Common Types of Manufacturing Insurance?

Manufacturing insurance encompasses several types of coverage, each tailored to address specific risks associated with the manufacturing industry.

- Property Insurance is essential, covering damages to buildings, equipment, and inventory. This ensures that physical assets are protected against unforeseen events.

- Liability Insurance offers protection against legal claims from third parties. This includes incidents like injuries or property damage caused by the manufacturer’s operations or products, safeguarding the business against claims that could otherwise be financially devastating.

- Business Interruption Insurance is crucial for compensating lost income when operations are halted due to covered events. This coverage ensures the manufacturer can recover financially and resume operations with minimal disruption.

Each type of insurance plays a vital role in providing a comprehensive safety net, allowing manufacturers to operate with confidence despite the inherent risks of their industry.

Property Insurance

Property insurance offers comprehensive coverage for physical damages to a manufacturer’s buildings, equipment, and inventory. This type of insurance is crucial for ensuring that physical assets are protected against unforeseen events such as fires, storms, or vandalism.

Coverage for Physical Damages

This coverage is designed to support the repair or replacement of damaged physical assets, helping manufacturers recover from losses without shouldering the entire financial burden themselves.

Liability Insurance

Liability insurance provides essential protection against legal claims from third parties. This includes claims related to injuries or property damage that may arise from the manufacturer’s operations or products.

Protection Against Legal Claims

Manufacturers benefit from liability insurance as it covers legal fees, settlements, and any damages awarded, safeguarding the company’s financial stability against potentially costly legal battles.

Business Interruption Insurance

Business interruption insurance is designed to compensate for lost income when manufacturing operations are disrupted due to covered events, such as natural disasters or critical equipment breakdowns.

Compensation for Lost Income

This type of insurance provides vital financial support, covering lost income and fixed expenses during the interruption period.

It enables manufacturers to maintain financial stability and continuity until normal operations can be resumed.

How Does Business Interruption Insurance Work with Supply Chain Disruptions?

Business interruption insurance plays a pivotal role in mitigating the financial impact of supply chain disruptions on manufacturing operations.

When manufacturers encounter disruptions—whether from natural disasters, political unrest, or vendor bankruptcy—this type of insurance provides crucial coverage for the lost income resulting from halted production or sales.

The coverage extends to losses incurred from disruptions affecting both direct suppliers and indirect suppliers, ensuring a comprehensive safety net for manufacturers.

To activate the coverage, it is essential for manufacturers to demonstrate the financial loss directly linked to the supply chain disruption, adhering to the policy’s documentation requirements.

The claim process involves submitting evidence of the disruption and quantifying the financial impact, which then informs the calculation of the loss covered by the policy.

This insurance coverage is designed to support manufacturers through periods of operational uncertainty, offering financial stability and assistance until the supply chain is restored and normal operations can resume.

Coverage Scope

The coverage scope of business interruption insurance regarding supply chain disruptions is designed to be comprehensive, covering disruptions related to both direct suppliers and indirect suppliers. This ensures a broad safety net for manufacturers, safeguarding against a wide range of potential supply chain issues.

Direct Suppliers

Direct suppliers refer to those businesses that provide materials or components directly used in the manufacturing process. Insurance coverage for disruptions among these suppliers is critical, as it directly impacts the manufacturer’s ability to maintain production schedules and fulfill orders.

Indirect Suppliers

Indirect suppliers, while not providing materials directly used in production, play an essential role in the supply chain’s functionality. Disruptions to these suppliers can indirectly affect manufacturing operations, making it important for coverage to extend to these entities as well.

Claim Process

The claim process necessitates that manufacturers submit a comprehensive report detailing the disruption, its cause, and the consequent impact on operations. This step is crucial for the verification of the claim and the determination of the appropriate compensation.

Evidence of Loss

Providing evidence of loss is a pivotal component of the claim process. Manufacturers are required to furnish documentation that clearly illustrates the financial repercussions of the supply chain disruption on their business operations.

Calculation of Loss

The calculation of loss entails a thorough analysis of the provided evidence to ascertain the financial compensation to be covered by the insurance. This calculation considers the disruption’s scope and its direct effect on the manufacturer’s revenue, ensuring an equitable compensation for the loss incurred.

What Factors Affect the Coverage of Supply Chain Disruptions?

The coverage of supply chain disruptions by manufacturing insurance is influenced by several key factors:

- Policy Specifics

Policy specifics play a crucial role, as the terms and conditions outlined in an insurance policy determine what types of disruptions are covered and under what circumstances.

For instance, some policies may cover disruptions caused by named storms but exclude those resulting from floods or earthquakes.

- Exclusions and Limitations

Exclusions and limitations within the policy can significantly impact the scope of coverage. Common exclusions in manufacturing insurance policies often include:

- Cyber-attacks: Many standard policies exclude losses from cyber incidents, requiring separate cyber insurance.

- Acts of war or terrorism: These are typically excluded but may be covered under specialized political risk insurance.

- Gradual wear and tear: Damage due to lack of maintenance is usually not covered.

- Certain natural disasters: Depending on the region, events like earthquakes or floods might require additional riders.

- Nature of the Disruption

The nature of the disruption itself affects coverage, with insurers assessing the cause, impact, and duration of a disruption when evaluating claims.

For example, a short-term power outage might be covered, while a prolonged energy crisis affecting an entire region might not be.

- Predictability and Preventability

Factors such as the predictability and preventability of the event are considered, as disruptions that could have been anticipated or mitigated may not be fully covered. Examples include:

- Seasonal weather events: If a manufacturer in a hurricane-prone area fails to implement adequate preparedness measures, coverage might be limited.

- Known supplier issues: If a manufacturer continues to rely on a supplier with a history of delivery problems, resulting disruptions might not be covered.

- Foreseeable political risks: Operating in countries with known political instability without proper risk management strategies could affect coverage.

- Due Diligence and Risk Management

Insurers often assess the manufacturer’s risk management practices. Demonstrating robust supply chain resilience strategies, such as supplier diversification or maintaining safety stocks, can positively influence coverage terms and claim outcomes.

- Policy Limits and Deductibles

The extent of coverage is also affected by policy limits and deductibles. Higher limits typically come with higher premiums, while higher deductibles can lower premiums but increase out-of-pocket expenses during a claim.

- Geographic Considerations

The location of the manufacturer and its suppliers can impact coverage.

Some regions may be considered higher risk for certain types of disruptions, which can affect policy terms and premiums.

How Can Manufacturers Ensure Comprehensive Coverage for Supply Chain Disruptions?

Manufacturers can ensure comprehensive coverage for supply chain disruptions by taking the following steps:

- Regularly Reviewing Insurance Policies

Manufacturers should conduct thorough policy reviews at least annually or whenever significant changes occur in their operations. Key elements to focus on include:

- Coverage limits: Ensure they align with current business valuation and potential losses.

- Named perils: Check if all relevant risks are included, such as natural disasters, cyber attacks, and political unrest.

- Geographical scope: Confirm coverage extends to all regions where you operate or source from.

- Supply chain tiers: Verify if coverage includes disruptions from both direct and indirect suppliers.

Questions to ask insurance providers:

- “How does this policy address emerging risks like climate change or global pandemics?”

- “What specific supply chain scenarios are excluded from coverage?”

- “How does the policy define and cover contingent business interruption?”

- Assessing Changes in Risk

Regularly assess changes in risk associated with supply chain operations. This involves:

- Conducting annual supply chain risk assessments

- Monitoring geopolitical developments in supplier countries

- Staying informed about industry-specific risks and trends

- Adding Specific Riders or Endorsements

Consider adding specialized riders or endorsements to existing policies for tailored coverage. Beneficial examples include:

- Contingent Business Interruption (CBI) endorsement: Covers losses from disruptions to key suppliers or customers.

- Political Risk endorsement: Protects against losses from political violence, expropriation, or currency inconvertibility.

- Cyber Risk rider: Covers losses from cyber attacks on your supply chain or critical IT systems.

Real-world example: After the 2011 Thailand floods, many manufacturers added flood-specific endorsements to their policies, significantly improving their coverage for future similar events.

- Opting for Supply Chain Specific Coverage

Invest in specialized supply chain insurance that addresses the nuances of supply chain disruptions. This might include:

- Trade disruption insurance: Covers financial losses from delays or cancellations in trade.

- Stock throughput policies: Provide end-to-end coverage for goods in transit and storage.

- Implementing a Layered Insurance Approach

Create a comprehensive insurance strategy by layering different types of coverage:

- Property insurance for physical assets

- Business interruption insurance for operational downtimes

- Cargo insurance for goods in transit

- Cyber insurance for digital risks

- Leveraging Data and Technology

Utilize supply chain mapping tools and risk analytics software to provide insurers with detailed information about your supply chain. This can lead to more accurate risk assessments and potentially better coverage terms.

- Collaborating with Insurance Brokers

Work closely with insurance brokers who specialize in manufacturing and supply chain risks.

They can provide valuable insights into:

- Emerging insurance products tailored to supply chain risks

- Industry benchmarks for coverage limits and types

- Claims processes and best practices for documentation

By taking these comprehensive steps, manufacturers can navigate the complexities of supply chain risks with greater confidence and security.

What are the Best Practices for Managing Risks of Supply Chain Disruptions?

To effectively manage the risks of supply chain disruptions, manufacturers should embrace several best practices:

- Diversifying Suppliers

Diversifying suppliers is crucial for reducing dependency on single sources. Effective strategies include:

- Multi-sourcing: Maintain relationships with multiple suppliers for critical components.

- Near-shoring: Bring some production closer to home markets.

- Supplier tiering: Categorize suppliers based on criticality and risk profile.

Real-life example: After the 2011 Fukushima disaster, Toyota implemented a “Rescue” system to quickly identify alternative suppliers, reducing their recovery time from months to weeks in future disruptions.

- Geographic Diversification

Spreading supply chain activities across various regions mitigates the impact of localized events:

- Regional manufacturing hubs: Establish production facilities in different global regions.

- Distributed warehousing: Maintain inventory across multiple locations.

- Flexible logistics networks: Develop adaptable transportation routes and modes.

Example: Unilever operates over 300 manufacturing sites across 69 countries, allowing them to shift production quickly during regional disruptions.

- Maintaining Inventory Reserves

Keeping adequate inventory reserves ensures continued production during short-term disruptions:

- Safety stock optimization: Use AI-powered demand forecasting to determine optimal safety stock levels.

- Strategic buffers: Maintain higher inventory for critical or long-lead-time items.

- Vendor-managed inventory (VMI): Collaborate with suppliers to manage on-site inventory.

Case study: Procter & Gamble uses advanced analytics to optimize its safety stock levels, reducing inventory costs while maintaining a 99.3% customer service level.

- Implementing Robust Supply Chain Management Tools

Leveraging technology for enhanced visibility and control:

- Supply Chain Control Towers: Centralized hubs for end-to-end supply chain visibility and decision-making.

- Blockchain technology: For improved traceability and transparency across the supply chain.

- IoT sensors: For real-time tracking of inventory and shipments.

- AI and Machine Learning: For predictive analytics and risk assessment.

Example: Merck implemented a Supply Chain Control Tower that reduced its response time to disruptions from days to hours.

- Risk Assessment and Scenario Planning

Regularly conduct comprehensive risk assessments and prepare for various scenarios:

- Digital twin technology: Create virtual models of the supply chain to simulate disruptions.

- Stress testing: Regularly test the supply chain against various disruption scenarios.

- Risk scoring: Develop a systematic approach to evaluate and prioritize risks.

Real-world application: Cisco uses stress testing to simulate various disruption scenarios, allowing them to identify vulnerabilities and develop targeted mitigation strategies.

- Collaborative Planning with Suppliers and Customers

Foster strong relationships and information sharing across the supply chain:

- Supplier development programs: Invest in improving key suppliers’ capabilities.

- Joint business continuity planning: Work with suppliers and customers to develop aligned resilience strategies.

- Real-time data sharing platforms: Implement systems for rapid communication of supply and demand changes.

Example: Walmart’s Supplier Alliance Program helps its suppliers improve their operations and resilience, benefiting the entire supply chain.

- Flexible Manufacturing and Distribution

Develop agility in production and logistics:

- Modular product design: Allows for easier substitution of components.

- Postponement strategies: Delay final product configuration to respond to demand changes.

- Multi-modal logistics: Ability to switch between transportation modes as needed.

Case study: Dell’s build-to-order model and postponement strategy allow it to quickly adapt to supply chain disruptions and demand fluctuations.

By adopting these strategies and leveraging advanced technologies, manufacturers can significantly enhance their resilience against supply chain disruptions.

The key is to create a flexible, transparent, and responsive supply chain ecosystem that can adapt quickly to unforeseen challenges, ensuring operational continuity and stability in an increasingly complex global business environment.

Safeguarding Your Manufacturing Business: The Next Step

In today’s complex manufacturing landscape, understanding and mitigating supply chain risks is crucial for your business’s success and longevity.

As we’ve explored, manufacturing insurance can indeed cover supply chain disruptions, offering a vital safety net against unforeseen challenges.

From business interruption insurance to specialized riders and endorsements, the right coverage can make all the difference when disruptions occur.

However, every manufacturing operation is unique, with its own set of risks and vulnerabilities.

That’s where The Allen Thomas Group comes in. With over 20 years of experience servicing businesses across the US, we specialize in crafting tailored insurance solutions for manufacturers just like you.

Ready to fortify your supply chain and protect your bottom line?

Take the first step towards comprehensive coverage today:

- Get a Free Business Insurance Quote: Let us analyze your specific needs and provide a customized insurance solution.

- Schedule a Consultation: Speak directly with our manufacturing insurance experts. Call us at (440) 826-3676 to set up your appointment.

Don’t wait for a disruption to expose gaps in your coverage.

Act now to ensure your manufacturing business is protected against the unexpected.

Contact The Allen Thomas Group today and secure your operation’s future with confidence.

Get The Right Business Insurance To Protect Your Manufacturing Company

Author